When applying for a loan—whether it’s a personal loan, car loan, home loan, or credit card—your credit score plays a crucial role in the lender’s decision. Many people get their loan applications rejected without understanding that their credit score is the main reason.

In this article, we’ll explain what a credit score is, how it affects loan approval, and what you can do to improve it.

What Is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. It shows lenders how responsibly you manage borrowed money.

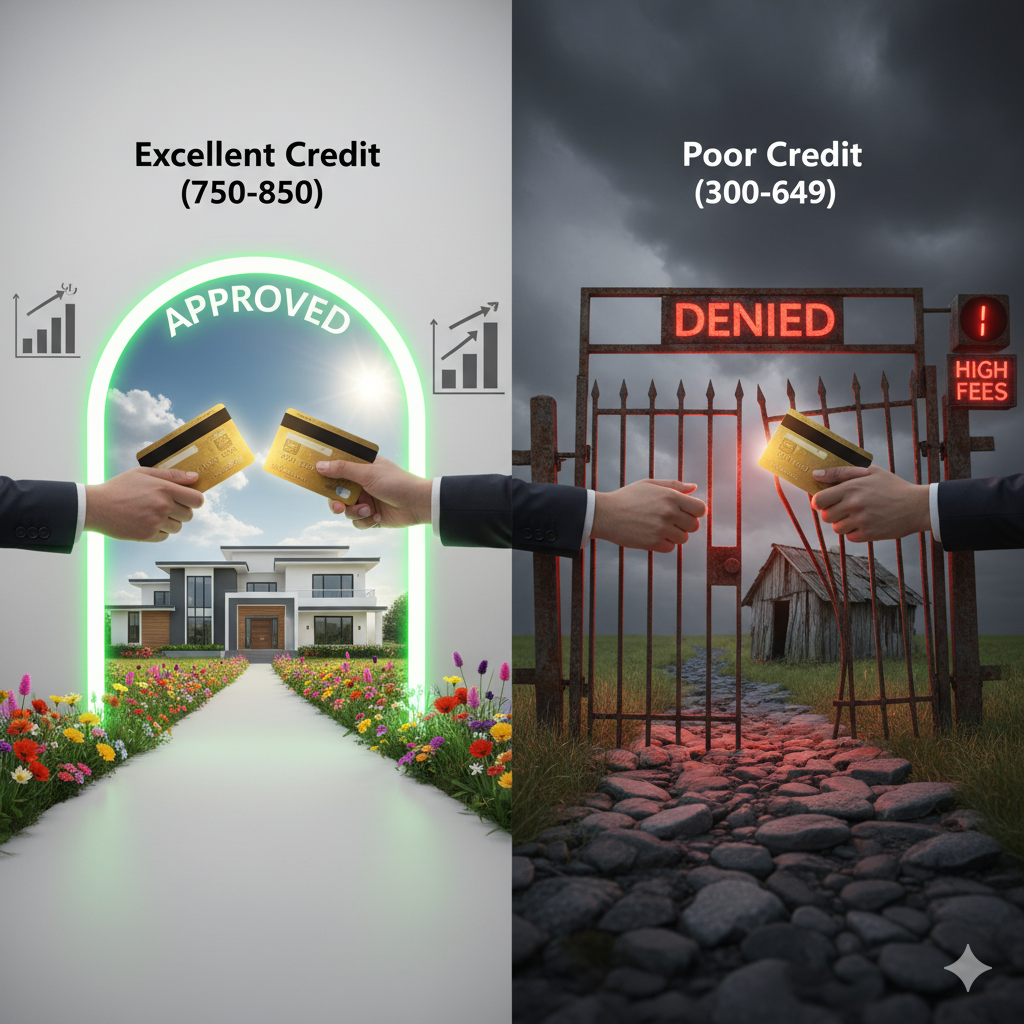

Typically, a credit score ranges from 300 to 850:

- Excellent: 750+

- Good: 700–749

- Fair: 650–699

- Poor: Below 650

The higher your score, the more trustworthy you appear to banks and financial institutions.

Why Lenders Check Credit Scores

Lenders use credit scores to:

- Measure the risk of lending money

- Decide whether to approve or reject a loan

- Set the interest rate

- Determine loan amount and repayment terms

A strong credit score means lower risk for the lender.

How Credit Score Affects Loan Approval

1. Loan Approval or Rejection

A low credit score significantly reduces your chances of loan approval. Many banks have minimum score requirements, and applications below that limit are often rejected automatically.

On the other hand, a high credit score increases approval chances, even for large loan amounts.

2. Interest Rates Offered

Your credit score directly affects the interest rate:

- High credit score: Lower interest rates

- Low credit score: Higher interest rates

Even a small difference in interest rate can save or cost you thousands over the loan period.

3. Loan Amount Eligibility

Applicants with good credit scores are often eligible for:

- Higher loan amounts

- Longer repayment tenures

Low scores may result in smaller loan offers or stricter conditions.

4. Faster Loan Processing

With a strong credit score:

- Less documentation is required

- Approval is faster

- Verification is smoother

Poor credit may lead to delays or additional checks.

5. Better Negotiation Power

A good credit score gives you leverage to:

- Negotiate interest rates

- Request flexible repayment options

- Choose from multiple lenders

Factors That Influence Your Credit Score

Your credit score is affected by:

- Payment history (on-time EMI and credit card payments)

- Credit utilization ratio

- Length of credit history

- Number of loan inquiries

- Types of credit used

How to Improve Your Credit Score for Better Loan Approval

Here are practical steps to boost your score:

✅ Pay EMIs and credit card bills on time

✅ Keep credit utilization below 30%

✅ Avoid applying for multiple loans at once

✅ Maintain old credit accounts

✅ Check credit report regularly for errors

Improving your credit score takes time, but consistent habits make a big difference.

Can You Get a Loan with a Low Credit Score?

Yes, but options are limited:

- Higher interest rates

- Lower loan amounts

- Requirement of a guarantor or collateral

Improving your score before applying is always a smarter choice.

Final Thoughts

Your credit score is one of the most important factors in loan approval. A good score not only increases your chances of approval but also helps you secure better interest rates, higher loan amounts, and flexible terms.

Before applying for any loan, make sure to check and improve your credit score—it can save you money and stress in the long run.